Correlation interpretation

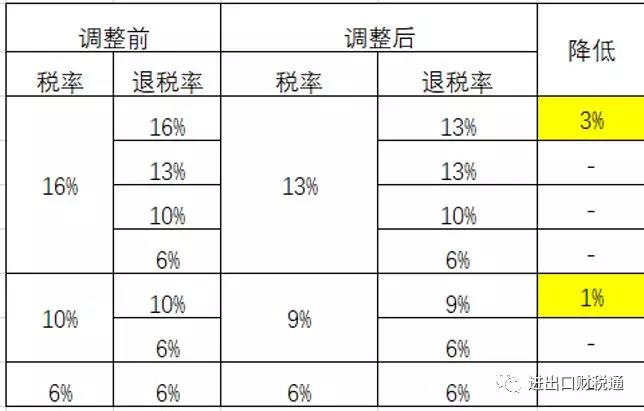

From April 1, 2019, the VAT rate of 16% will be adjusted to 13% and 10% to 9%; At the same time, the tax rebate rate of export goods and services and cross-border taxable services is adjusted, that is, the original tax rebate rate of 16% is adjusted to 13%, the original tax rebate rate of 10% and the tax rebate rate of 10% is adjusted to 9%, and the transition period of the tax rebate rate is set (Note: The transitional period is only valid for goods, services and cross-border services with the original tax rate of 16% and the rebate rate of 16%, and the original tax rate of 10% and the rebate rate of 10%. There is no transition period for other goods, services and cross-border services with tax rebates!) That is, June 30, 2019 as the cut-off point for the transition.

Export enterprises should pay attention to the changes in the tax rebate rate when applying for export tax rebates:

1. Export of goods and services

(1) Goods and services exported on or before June 30, 2019

For goods and services whose original tax rate and tax rebate rate are 16%, whether the special invoice with 16% or 13% tax rate is obtained, the tax rebate rate shall be uniformly applied for at 13%.

For goods and services with the original tax rate of 10% and a tax rebate rate of 10%, whether the special invoice with a tax rate of 10% or 9% is obtained, the tax rebate rate shall be uniformly applied for at 9%

If you have obtained a special invoice of 3% for the purchase of goods and services by simple taxation or small scale taxpayers, you can apply for a tax refund at the 3% tax rebate rate

The comprehensive service enterprises that export on behalf of production enterprises and charge tax refund shall be subject to the above-mentioned foreign trade enterprises.

2. Production enterprises using "credit exemption"

Goods and services exported on or before June 30, 2019, shall continue to apply for tax refund at the original tax rebate rate, that is, if the original tax rate and tax rebate rate are both 16%, they shall continue to apply for tax refund at 16%, and if the original tax rate is 10% and the tax rebate rate is 10%, they shall continue to apply for tax refund at 10%.

Goods and services exported on or after July 1, 2019, shall be uniformly applied for tax refund at the adjusted tax rebate rate, that is, the original 16% tax rebate rate shall be applied for tax refund at the 13% tax rebate rate, and the original 10% tax rebate rate shall be applied for tax refund at the 9% tax rebate rate

2. Cross-border taxable behavior

For cross-border services, since customs declaration is not required, the issue date of the export invoice is adopted as the transition time point

1. Foreign trade enterprises that implement "exemption from withdrawal"

(1) If the export invoice is issued on or before June 30, 2019, if a special ticket with a 10% tax rate is obtained, the tax refund shall continue to be applied at the 10% tax rate; Obtain a special invoice with 9% tax rate, and apply for a refund at 9% tax rate

(2) If the export invoice is issued on or after July 1, 2019, regardless of whether the special ticket of 10% or 9% tax rate is obtained, the tax refund rate shall be uniformly applied for at 9%

(3) A 3% special ticket obtained from a simple tax or small scale taxpayer, regardless of the date of issue of the export invoice before or after June 30, 2019, shall be claimed at the 3% rebate rate

2. Production enterprises or part of foreign trade enterprises that implement the "exemption"

If the export invoice is issued on or before June 30, 2019, the tax refund rate shall be applied for at 10%;

If the export invoice is issued on or after July 1, 2019, the tax refund rate is 9%

Note: The export invoice shall be issued when the VAT tax obligation is reached. Export enterprises that provide cross-border taxable behaviors overseas should pay attention to this risk: for those who meet the tax obligation on or before June 30, 2019, they should be issued in time, otherwise, once they are issued after July 1, 2019, they can only apply for tax refund at the 9% tax rebate rate; Similarly, for those who have not reached their tax obligation before July 1, 2019, there will be risks if they are issued in advance and apply for a tax refund at the original 10% tax rebate rate. Cross-border services must be in accordance with the tax obligation to issue export invoices!

3. The tax rebate rates for other goods and services and cross-border services remain unchanged.

That is, the tax rebate rate for goods, services and cross-border taxable services whose tax rate is inconsistent with the tax rebate rate (the original tax rate is 16% but the tax rebate rate is 13%, 10%, 6%; Or the tax rate is 10%, but the rebate rate is 6%); If the tax rate is 6% and the tax rebate rate is 6%, the original tax rebate rate shall continue to be implemented.

Original announcement attached

In order to implement the decision-making and deployment of the Party Central Committee and The State Council and promote the substantive reduction of value-added tax, the relevant matters concerning the 2019 value-added tax reform are hereby announced as follows:

1. Where a general VAT taxpayer (hereinafter referred to as a taxpayer) has a VAT taxable sale or import of goods, the tax rate previously applied to 16% shall be adjusted to 13%; Where the tax rate used to be 10%, the tax rate shall be adjusted to 9%.

2. For taxpayers purchasing agricultural products, where the deduction rate originally applied to 10%, the deduction rate shall be adjusted to 9%. The input tax shall be calculated at the deduction rate of 10% for the agricultural products purchased by taxpayers for the production or commissioned processing of goods with a tax rate of 13%.

For export goods and services that used to be subject to 16% tax rate and whose export tax rebate rate is 16%, the export tax rebate rate shall be adjusted to 13%; For export goods and cross-border taxable activities that were previously subject to a 10% tax rate and an export tax rebate rate of 10%, the export tax rebate rate will be adjusted to 9%.

Before June 30, 2019 (including April 1, 2019), the taxpayer exports the goods and services mentioned in the preceding paragraph, the cross-border taxable acts mentioned in the preceding paragraph, the VAT exemption and refund method is applicable, the VAT has been levied at the pre-adjustment tax rate at the time of purchase, the export rebate rate before adjustment shall be implemented, and the VAT has been levied at the adjusted tax rate at the time of purchase. Implement the adjusted export tax rebate rate; Where the VAT exemption method is applicable, the export tax rebate rate before the adjustment is implemented, and when calculating the exemption tax, the applicable tax rate is lower than the export tax rebate rate, the difference between the applicable tax rate and the export tax rebate rate is deemed to be zero participation in the calculation of the exemption tax.

The implementation time of the export tax rebate rate and the time of the export of goods and services and the occurrence of cross-border taxable acts shall be implemented in accordance with the following provisions: for the export of goods and services declared for export (except the export from the bonded area and through the bonded area), the export date indicated in the Customs export declaration shall prevail; For goods and services exported without customs declaration and cross-border taxable activities, the issuing time of export invoice or ordinary invoice shall prevail; For goods exported from the bonded area or through the bonded area, the date of export indicated in the record list of exit goods issued by the Customs at the time of departure shall prevail.

(4) The tax refund rate for the goods purchased by overseas passengers leaving the country at 13% tax rate is 11%; The tax rebate rate of 8% is applied to the 9% tax rate of the goods purchased by overseas passengers.

Before June 30, 2019, if VAT is levied at the pre-adjustment rate, the pre-adjustment rebate rate shall be implemented; Where VAT is levied on the basis of the adjusted tax rate, the adjusted tax rebate rate shall apply.

The implementation time of the tax refund rate shall be based on the issuing date of the ordinary VAT invoice for the tax refund items.Since April 1, 2019, the Provisions on Matters related to the Pilot Reform of Business Tax to Value-added Tax (Finance and Taxation [2016] No. 36 issued) Article 1, Item (4), item (1), item (1) of Article 2 will be suspended, and the input tax of taxpayers who have acquired immovable property or immovable property projects under construction will no longer be deducted for two years. The input tax that has not been deducted in accordance with the above provisions can be deducted from the output tax as of April 2019.

Where a taxpayer purchases domestic passenger transport services, the input tax is allowed to be deducted from the output tax.

(1) If the taxpayer does not obtain the special VAT invoice, the input tax shall be temporarily determined in accordance with the following provisions:

1. Where an electronic ordinary VAT invoice is obtained, the amount of tax indicated on the invoice shall be the same;

2. Where an air transport electronic passenger ticket itinerary indicating passenger identity information is obtained, the input tax shall be calculated in accordance with the following formula:

Air passenger transport input tax = (fare + fuel surcharge) ÷ (1+9%) ×9%

(3) Where a railway ticket indicating the identity information of the passenger is obtained, the input tax calculated according to the following formula:

Railway passenger transportation input tax = ticket amount ÷ (1+9%) ×9%

4. For highway, waterway and other passenger tickets indicating the identity information of passengers, the input tax shall be calculated according to the following formula:

Road, waterway and other passenger transportation input tax = ticket amount ÷ (1+3%) ×3%

(2) "Implementation Measures for the Reform of Business Tax to Value-added Tax pilot" (Finance and Taxation [2016] No. 36 issued) Article 27 (6) and "Provisions on Matters related to the reform of Business tax to Value-added Tax pilot" (Finance and taxation [2016] No. 36 issued) Article 2 (1) item 5 of the "purchased passenger transport services, loan services, catering services, residents' daily services and entertainment "Music Services" is amended to "purchased loan services, catering services, resident daily services and entertainment services".

From April 1, 2019 to December 31, 2021, taxpayers of production and domestic service industries are allowed to deduct 10% more of the input tax deductible in accordance with the current period to offset the tax payable (hereinafter referred to as the additional deduction policy).

(1) Taxpayers of production and living services as mentioned in this announcement refer to taxpayers who provide postal services, telecommunication services, modern services and living services (hereinafter referred to as the four services) whose sales account for more than 50% of the total sales. The specific scope of the four services is implemented in accordance with the "Sales Services, Intangible Assets, real Estate Notes" (Finance and Taxation [2016] No. 36 issued).

For taxpayers established before March 31, 2019, whose sales during the period from April 2018 to March 2019 (if the operating period is less than 12 months, according to the sales during the actual operating period) meet the above specified conditions, the additional deduction policy will apply from April 1, 2019.

For taxpayers established after April 1, 2019, if the sales of 3 months from the date of establishment meet the above specified conditions, the additional deduction policy will apply from the date of registration as a general taxpayer.

After the taxpayer determines that the additional deduction policy is applicable, it will not be adjusted within the current year, and whether it is applicable in subsequent years shall be calculated according to the sales volume of the previous year.

The amount of additional credit or deduction that the taxpayer can deduct but does not deduct may be deducted together with the period in which the additional credit or deduction policy is determined to apply.

(2) The taxpayer shall calculate the additional deduction amount for the current period according to 10% of the input tax that can be deducted for the current period. The input tax that cannot be deducted from the output tax according to the current regulations shall not be deducted from the amount of additional credit; Where the input tax has already been deducted and the amount of the deduction is transferred out according to the provisions, the amount of the deduction shall be adjusted and increased accordingly in the period when the input tax is transferred out. The calculation formula is as follows:

Amount of additional deductions accrued for the current period = Input tax deductible for the current period ×10%

Current deductible plus deductible = Balance of previous period plus deductible + current period plus deductible - current period plus deductible

(3) Taxpayers shall, after calculating the tax payable under the general tax calculation method (hereinafter referred to as the tax payable before the deduction) in accordance with the current provisions, add the deduction according to the following circumstances:

1. If the tax payable before the deduction is equal to zero, the total amount of the deduction and deduction can be carried forward to the next period;

2. If the tax payable before the deduction is greater than zero and greater than the deductible amount of the current period, the full amount of the deductible amount of the current period is deducted from the tax payable before the deduction;

3. If the tax payable before the deduction is greater than zero, and is less than or equal to the deductible plus deductible for the current period, the tax payable shall be reduced to zero by the deductible plus deductible for the current period. The amount of the current period that has not been offset can be deducted and added to the deduction and carried forward to the next period to continue the deduction.

(4) Taxpayers exporting goods and services, cross-border taxable behavior is not applicable to the additional deduction policy, its corresponding input tax shall not be deducted from the additional deduction amount.

Input tax for taxpayers concurrently engaged in export goods and services, cross-border taxable activities, and unable to divide the amount not subject to deduction and deduction, shall be calculated according to the following formula:

Input tax not eligible for deduction = all input tax that cannot be divided in the current period × sales of export goods and services and cross-border taxable activities in the current period ÷ all sales in the current period

(5) The taxpayer shall separately account for the changes in the provision, deduction, adjustment and balance of the additional deduction. Those who fraudulently apply the additional deduction policy or falsely increase the amount of deduction shall be dealt with in accordance with the relevant provisions of the Law of the People's Republic of China on the Administration of Tax Collection.

(6) After the expiration of the implementation of the additional deduction policy, the taxpayer will no longer deduct the additional deduction amount, and the remaining additional deduction amount will cease to be deducted.

8. Starting from April 1, 2019, we will try out a tax rebate system for VAT credits at the end of the period.

(1) Taxpayers who meet the following conditions at the same time may apply to the competent tax authorities for refund of the incremental tax credit:

1. Starting from the tax period in April 2019, the incremental retained tax credit is greater than zero for six consecutive months (quarterly tax payment, two consecutive quarters), and the incremental retained tax credit for the sixth month is not less than 500,000 yuan;

2. The tax credit rating is level A or B;

3. No fraudulent withholding of tax rebates, export tax rebates or false issuance of special VAT invoices have occurred in the 36 months prior to applying for tax rebates;

4. Not punished twice or more by tax authorities for tax evasion within 36 months before applying for tax refund;

5. Since April 1, 2019, those who do not enjoy the policy of immediate tax return or return after tax return (return).

(2) The incremental retained tax credit mentioned in this announcement refers to the newly increased end-of-period retained tax credit compared with the end of March 2019.

(3) The incremental tax credit allowed to be refunded by the taxpayer for the current period shall be calculated according to the following formula:

Incremental refundable tax credit = incremental tax credit x input component x 60%

The input composition ratio is the proportion of the VAT specified in the special VAT invoice (including the unified invoice for the sale of tax-controlled motor vehicles), the special payment letter for customs import VAT, and the tax payment certificate of the tax paid in the total input tax deducted during the same period from April 2019 to the period before the application for tax refund.

(4) Taxpayers shall apply to the competent tax authorities for refund of the retained tax credit within the period of VAT declaration.

(5) Taxpayers export goods and services, cross-border taxable behavior, applicable to the tax exemption method, after the tax exemption, still meet the conditions stipulated in this announcement, can apply for refund of the tax credit; Where tax exemption is applicable, the relevant input tax shall not be used to refund the retained tax credit.

(6) After the taxpayer obtains the refund of the retained tax credit, the tax credit for the current period shall be adjusted accordingly. Where the conditions for tax refund are met again in accordance with the provisions of this Article, the applicant may continue to apply to the competent tax authorities for the refund of the retained tax credit, provided that the continuous period specified in Item (1) of this article shall not be repeated.

(7) Where a tax refund is retained by fraudulent means such as false promotion, false declaration or other deceptive means, the tax authorities shall recover the tax refund fraudulently obtained and deal with it in accordance with the Law of the People's Republic of China on the Administration of Tax Collection and other relevant provisions.

(8) The central and local sharing mechanisms for refunded incremental tax credits will be notified separately.

9. This announcement shall take effect as of April 1, 2019.

It is hereby announced.

General Administration of Customs, Taxation Administration, Ministry of Finance

March 20, 2019