How to find the US HTS CODE and import duties?

Us International Trade Commission website:

http://www.usitc.gov/tata/hts/bychapter/index.htm

Inquiry method:

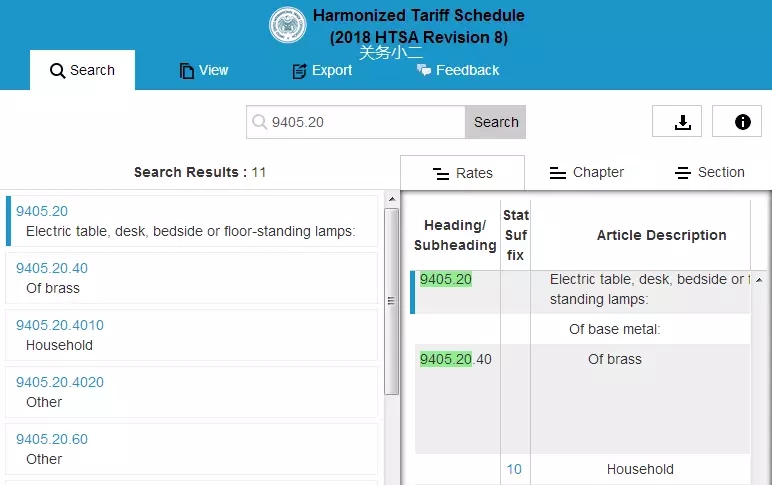

1. Query the HTS CODE: Go to the above website and Search the current Harmonized Tariff Schedule under Tariff Assistance... Enter the first six digits of Chinese HS CODE in the search box below, such as table lamp 940520****. The detailed HTS CODE is displayed in the left border of the search results page. Choose HTS CODE according to your product.

Remind everyone,Export to the United States, remember to take the initiative to check whether the product is included in the tax list, and take the initiative to contact the United States buyers to verify the situation. Whether it is an order under DDP terms or an Amazon operation in the United States, it is necessary to confirm the United States customs clearance tariffs in advance.

How can I check if my product is on the US tariff list?

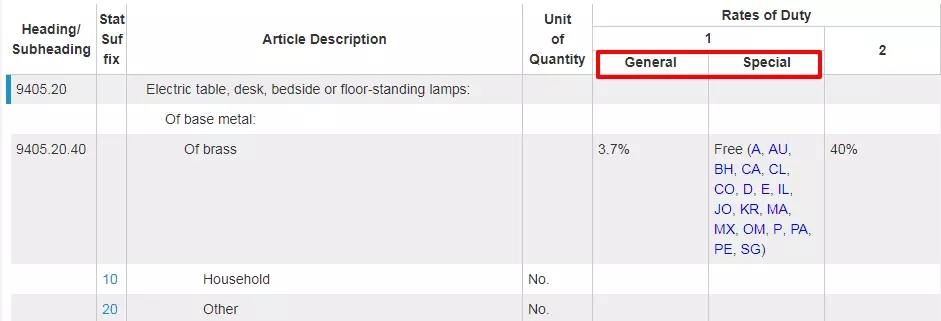

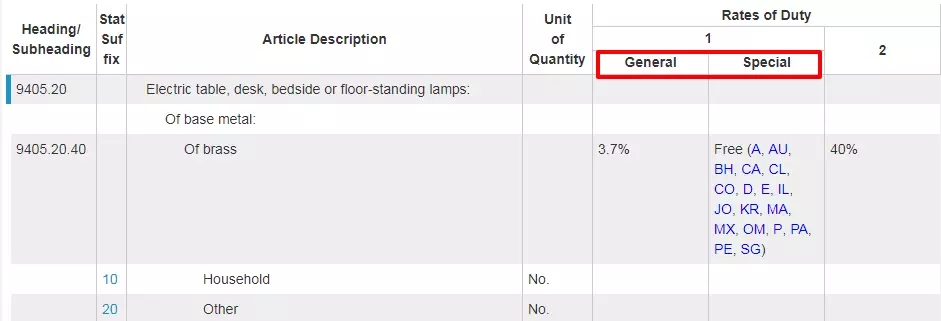

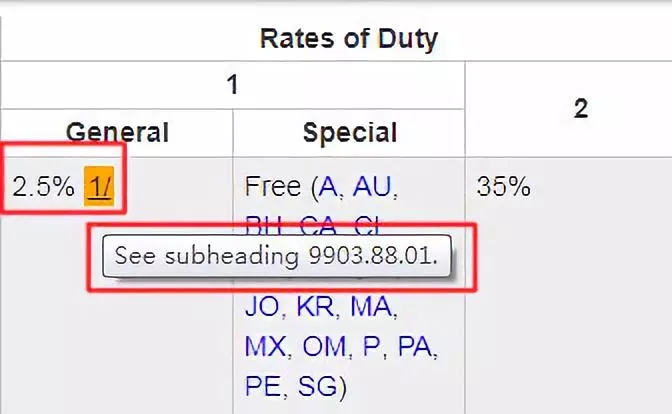

Continue our query of HTS code in the previous step, for specific products, you can see in“Rates of Duty”There are several columns, which column should you look at?

"General" in "1" refers to tariffs on most products imported from the world (including China), and "Special" refers to relevant free trade agreements with the United StatesNational import duties (often free, but not for Chinese companies);

"2" refers to a special trade restriction that has no trade relationship with the United StatesImport tariffs for countries (e.g. North Korea).

So, we look at the "General" tax rate. That's when a lot of people have to ask:“General”The tax rate hasn't changed, it hasn't added 25%, No tax hike?

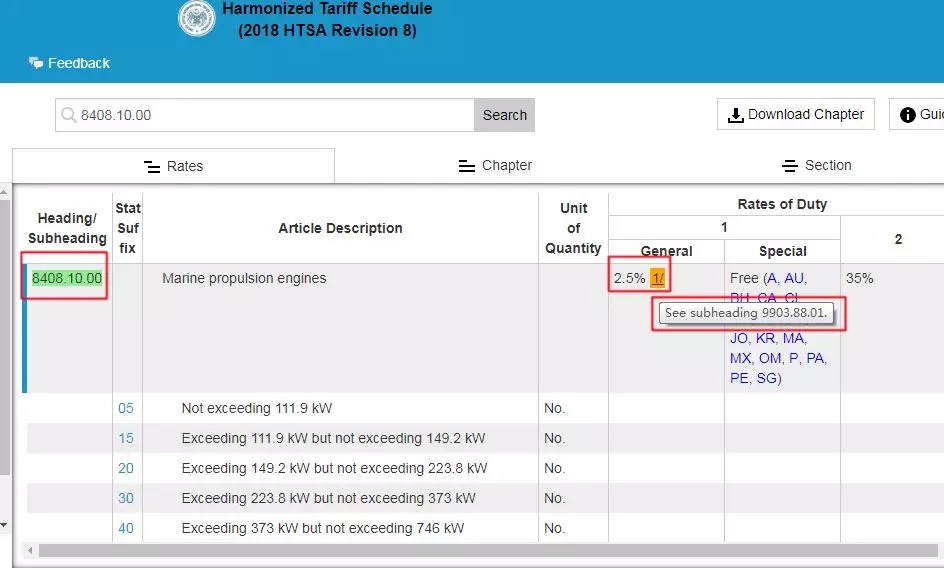

Please note if you put a small "1" after the "General", continue reading below.

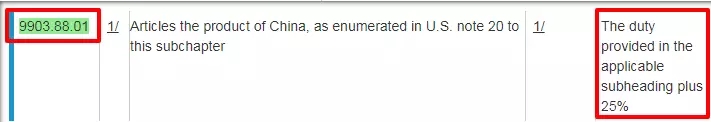

We take the tax code "8408.10.00 Marine propulsion engine" in the United States as an example to demonstrate. This product is listed in <span class="chrome-extension-mutihighlight Chrome-extension-mutihighlight-style-3 "style="color:#ffffff; margin: 0px; padding: 0px 3px; border-radius: 3px; box-shadow: rgba(0, 0, 0, 0.3) 1px 1px 3px; text-decoration-line: none; background: red;" In the first batch of $34 billion in tax increases, its import tax rate was previously shown as 2.5 percent in "General." But it is now followed by a "1" that tells us to look at the subheading "9903.88.01" again.

Continue to search for "9903.88.01" in the web page, it is clearly mentioned here that this part of the Chinese products on the basis of the applicable tax rate of 25%.

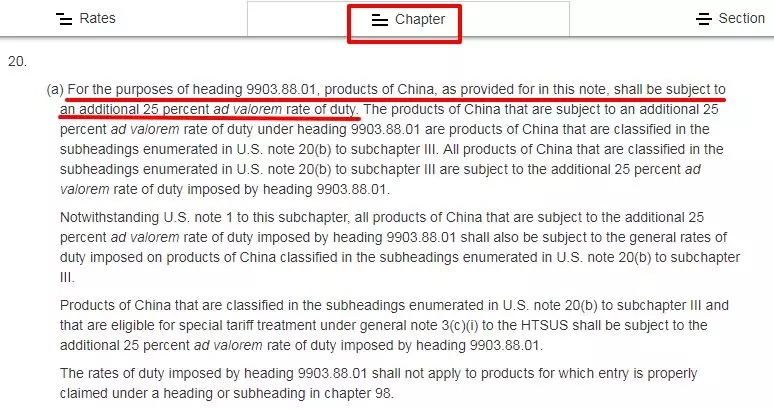

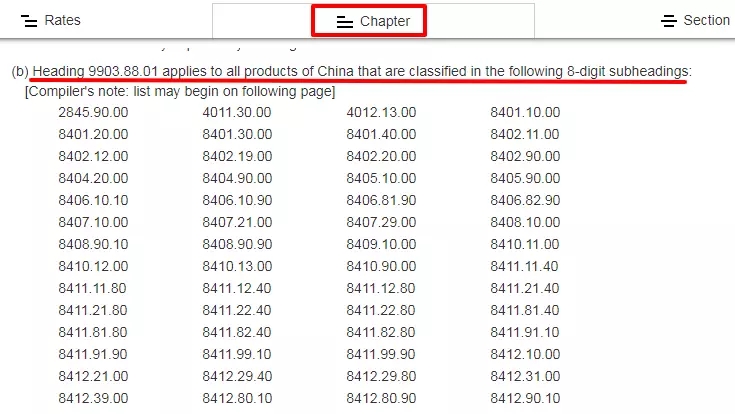

What is the "note 20" mentioned in this sentence? I found this note 20 under the "Chapter" page,It is an explanation for the increase in taxes on Chinese products. It is clearly stated here that 25% is an additional tax rate.The encodings that fall under "9903.88.01" are also further listed below.

本文转载至搜航网 General: China Ministry of Commerce, Shipping network, Customs minor two,USTR